Our Offshore Banking PDFs

Table of ContentsWhat Does Offshore Banking Do?Examine This Report on Offshore BankingThe 8-Second Trick For Offshore BankingThe Single Strategy To Use For Offshore BankingThe smart Trick of Offshore Banking That Nobody is Talking About

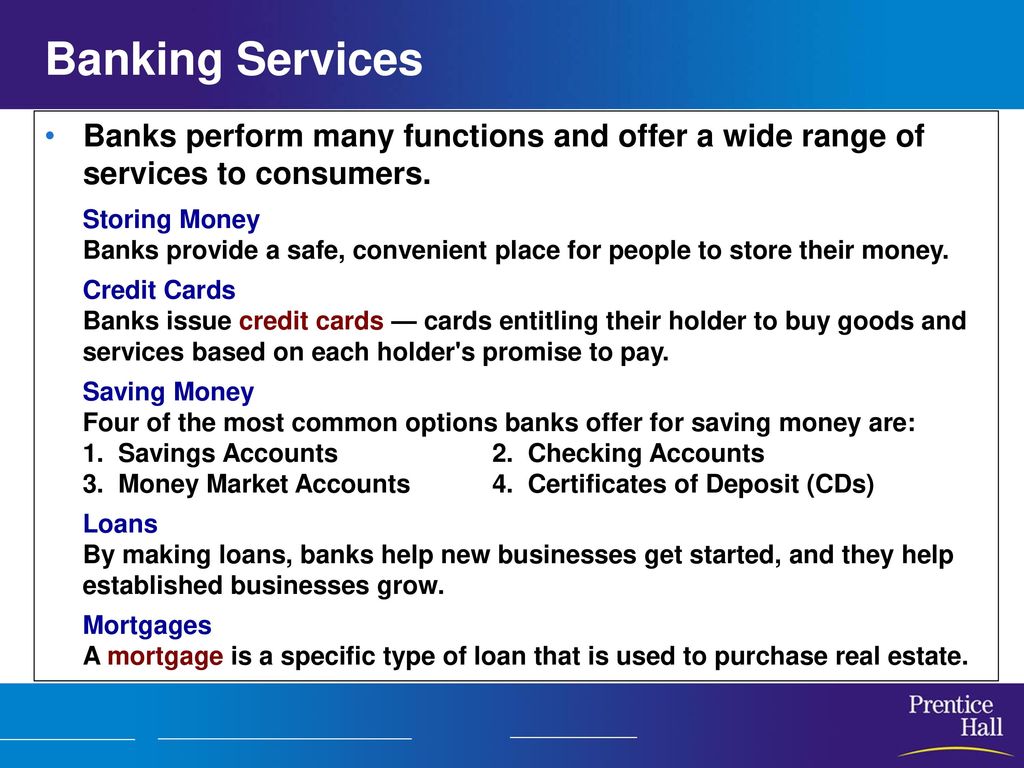

Some usual kinds of financings that financial institutions supply consist of: If your present economic organization does not use the services pointed out above, you may not be obtaining the most effective banking solution feasible. In The Beginning Bank, we are devoted to helping our clients obtain one of the most out of their money. That is why we offer various kinds of banking services to satisfy a variety of demands.

Pay expenses, rent or cover up, buy transport tickets and even more in 24,000 UK locations

If you get on the quest for a new monitoring account or you intend to begin investing, you may require to set aside time in your routine to do some study. That's because there are lots of sort of financial institutions and also banks. By comprehending the different kinds of financial institutions as well as their functions, you'll have a better sense of why they are very important and just how they play a duty in the economic climate.

Indicators on Offshore Banking You Need To Know

In terms of financial institutions, the central financial institution is the head boss. Main financial institutions take care of the money supply in a solitary country or a series of countries.

Retail banks can be standard, brick-and-mortar brands that clients can access in-person, on the internet or via their mobile phones. Others only make their devices and accounts available online or with mobile apps. There are some types of business financial institutions that assist daily consumers, business financial institutions have a tendency to focus on sustaining companies.

The darkness financial system includes economic teams that aren't bound by the exact same strict regulations as well as laws that banks have to adhere to. Just like the conventional regulated financial institutions, shadow financial institutions take care of credit history as well as different kinds of properties. They get their funding by borrowing it, linking with financiers or making their own funds rather of making use of money provided by the central financial institution.

Cooperatives can be either retail banks or business banks. What distinguishes them from various other entities in the financial system is the fact that they're typically local or community-based associations whose members assist identify exactly how business is run. They're run democratically and also they use financings and financial institutions accounts, amongst various other points.

The Ultimate Guide To Offshore Banking

they usually take the kind of lending institution. Like banks, lending institution provide loans, provide financial savings and inspecting accounts and meet other monetary demands for customers and services. The difference is that banks are for-profit firms while lending institution are not. Lending institution fall under the direction of their very own members, who choose based upon the opinions of chosen board participants.

In the past, S&Ls generally acted as participating organizations. Members benefited from the S&L's services and also earned more passion from their cost savings than they can at industrial financial institutions. For a while, S&Ls weren't managed by the federal government, yet currently the federal Workplace of Second hand Supervision manages their task. Not all financial institutions offer the very same objective.

With time, they have actually been commonly made use of by both sophisticated reserve supervisors and Learn More Here also by those with even more uncomplicated requirements. Sight/notice accounts and taken care of as well as drifting price down payments Fixed-term down payments, also denominated in a basket of currencies such as the SDR Flexible amounts as well as maturations An attractive investment commonly utilized by reserve managers looking for additional yield as well as superior debt quality.

This paper provides an approach that banks can use to assist "unbanked" householdsthose that do not have accounts at down payment institutionsto join the mainstream financial system. The primary purpose of the method is to assist these families develop cost savings as well as boost their credit-risk accounts in order to reduce their expense of repayment services, eliminate a common source of individual stress, and gain access to lower-cost sources of credit report.

The Facts About Offshore Banking Revealed

Second, it will certainly provide them a collection of services far better created to meet their demands. Third, it is better structured to aid the unbanked become typical financial institution helpful resources customers. 4th, it is likewise likely to be a lot more lucrative for financial institutions, making them a lot more going to apply it. A number of surveys have actually checked out the socioeconomic attributes of the approximately 10 million families that do not have checking account.

They have no instant need for credit or do not discover that their unbanked condition excludes them from the credit history that they do need. Repayment solutions are also not problematic for a variety of reasons. Lots of obtain and also make few non-cash payments. Others money incomes absolutely free at an accommodating deposit organization, grocery shop, or various other business.

A lot of financial institutions in city areas will not cash paychecks for individuals that do not have an account at the bank or who do not have an account with enough funds in the account to cover the check. It can be rather costly for a person living from paycheck to income to open a bank account, also one with a reduced minimum-balance need.

Each jumped check can set you back the account owner $40 or even more given that both the check-writer's financial institution and the vendor who approved the check commonly impose penalty charges. It is also costly and also troublesome for financial institution customers without checking accounts to make long-distance settlements. Nearly all banks charge at the very least $1 for money orders, and numerous charge as much as $3.

Rumored Buzz on Offshore Banking

As noted in the intro, this paper suggests that the most reliable as well as affordable means to next bring the unbanked right into the banking system need to entail 5 actions. Below is an explanation of each of those measures and their reasonings. The primary step in the proposed approach contacts taking part banks to open specialized branches that provide the full variety of business check-cashing solutions along with basic consumer financial services.